Table of Contents

ToggleFeeling overwhelmed by Indonesia’s tax landscape? As a company, family office, or entrepreneur, minimizing your tax burden while adhering to regulations can seem like a complex puzzle. But worry not, effective tax planning, tailored to your needs, can be your guide to optimizing taxation in Indonesia.

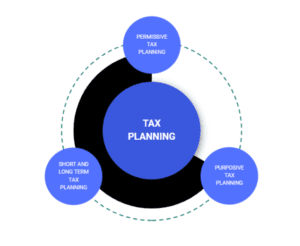

What is Tax Planning?

Think of it as strategizing your finances to keep more of your hard-earned money. It’s about using legal methods to leverage available allowances, deductions, and exemptions offered by the Indonesian government.

Why should I consult for tax planning?

- Save money: Reduce your tax liability and keep more of your income for growth, investment, or rewarding your team.

- Peace of mind: Knowing your taxes are handled efficiently can alleviate stress and uncertainty.

- Stay competitive: Smart tax planning can give you an edge in the dynamic Indonesian market.

Tax Planning a Strategies for Success in Indonesia:

- Investment Savvy: Utilize tax-advantaged investments like Pensiun Dana Manfaat Pemberhentian (PDMP) or Sukuk Wakalah to optimize returns and reduce taxable income.

- Deduction Detectives: Claim legitimate deductions for business expenses, research and development, or employee training to lower your tax bill.

- Timing Tricks: Strategically adjust the timing of income and expenses to fall into lower tax brackets or benefit from specific deductions.

- Compliance Champions: Partner with our team of experienced tax consultants to stay updated on regulations and navigate the evolving tax landscape with confidence.

Never worry about taxes and accounting again

Dealing with finances, taxes, and accounting can feel overwhelming, especially as a foreigner in Indonesia. Let us guide you through processes like tax calculation, payroll, personal or corporate tax, short-term investments, balance sheet analysis and much more.

With ILA by your side, nothing can go wrong. Schedule a free consultation today or learn more about our tax and accounting services.

Is tax planning only for high-net-worth individuals or big companies?

No, absolutely not! While complex tax planning strategies might be more relevant for high net-worth individuals or large corporations, the fundamentals of smart tax optimization apply to everyone, regardless of income level or business size.

Read also: Corporate Income Tax in Indonesia.

Here’s why:

- Everyone pays taxes: Whether you’re a salaried employee, a freelancer, or a small business owner, everyone faces some form of taxation in Indonesia. Minimizing your tax burden, even by a small percentage, can make a significant difference in your disposable income.

- Simple strategies can have a big impact: Even basic tax planning measures like claiming eligible deductions, utilizing tax-advantaged accounts, and understanding income brackets can lead to noticeable savings.

Here are some concrete examples of how tax planning can benefit individuals and small businesses in Indonesia:

- Salaried employees: Claiming deductions for medical expenses, education costs, or dependent care can lower your taxable income and reduce your tax bill.

- Freelancers: Utilizing micro business tax regulations or setting up a Pensiun Dana Manfaat Pemberhentian (PDMP) can offer substantial tax benefits and secure your future savings.

- Small businesses: Optimizing depreciation deductions, claiming legitimate business expenses, and understanding VAT regulations can contribute to significant tax savings and boost your bottom line.

Tax planning is not exclusively for the wealthy or the big players. Even small steps towards optimization can lead to significant savings and contribute to your financial well-being. Don’t underestimate the power of smart tax planning, regardless of your income or business size.

- Start early: The sooner you implement tax-efficient strategies, the greater the long-term impact on your wealth accumulation.

- Seek professional guidance: While basic strategies can be managed independently, consulting a qualified tax consultant can unlock more complex optimization opportunities and ensure compliance with regulations.

- Tax laws are complex and subject to change. Consulting with our qualified tax consultants ensures you stay compliant and optimize your tax strategy.

- Never engage in illegal tax schemes. We prioritize ethical and transparent approaches to maximize your savings while respecting regulations.

Case Study: Simplifying Taxes for a Family Office

Meet the Wijayas, a successful family operating a thriving manufacturing business in Indonesia. Their family office manages their diverse portfolio, including the business, real estate investments, and personal wealth. However, their tax bill threatened to significantly eat into their profits and future investment plans.

The Wijayas relied heavily on traditional income generation methods, unaware of tax-efficient strategies. This resulted in a higher tax burden than necessary. Additionally, their portfolio lacked diversification, limiting opportunities for optimization.

Read also: Personal Income Tax In Indonesia

Action plan

Our tax consultants partnered with the Wijayas to implement a tailored plan:

- Investment Diversification: We recommended investing in Pensiun Dana Manfaat Pemberhentian (PDMP), a tax-advantaged retirement scheme offering attractive returns and tax deductions on contributions.

- Real Estate Optimization: We analyzed their rental properties and identified opportunities to utilize depreciation deductions and optimize rental income timing to minimize tax impact.

- Expense Management: We reviewed their business expenses and suggested strategies to claim legitimate deductions for essential costs like research and development, employee training, and technology upgrades.

By implementing these tax-efficient strategies, the Wijayas:

- Reduced their tax bill by 20%, freeing up significant capital for reinvestment and family goals.

- Boosted their long-term wealth through PDMP investments and optimized real estate income.

- Gained peace of mind knowing their tax affairs were handled efficiently and legally.

The Takeaway

Working with tax consultants, companies, and family offices in Indonesia can unlock significant tax savings. You can secure financial stability and fuel your future growth.

Don’t let taxes be a burden. Contact ILA today to explore personalized tax planning strategies and navigate the Indonesian tax landscape with confidence.