Table of Contents

ToggleThe largest economy of Southeast Asia is attracting each year more and more foreign direct investments (90 billion USD in 2023). As a company or an individual willing to invest and create a company in Indonesia, there are several types of business entities that investors can choose to enter the market. Despite Indonesia having several forms of companies (PT PMDN, CV, PT Perorangan), only two classes of companies are open to foreigners: the PT PMA (a form of LLC) and the representative office (BUJKA, KPPA, KP3A, JPTLA, KP3A PMSE). Here are the most frequent questions companies or individuals ask before starting a company in Indonesia.

1. Are all sectors open for investment?

In 2021, Indonesia opened most of its sectors to foreign investment. Sectors such as e-commerce or clinics are now eligible for foreign investment. Foreigners can open companies in Indonesia without partnering with Indonesians for most of the sectors. Some activities are prohibited in Indonesia as in the image below (from BKPM report 2022).

Registering a company in Indonesia has never been easier

Setting up a business abroad can be challenging with so many documents, laws and regulations to consider. Luckily, the process will be a breeze, and we’ll give you expert advice on which business structure and setup will fit your needs.

Reach out to the ILA team today to set up a free consultation or read more about the company registration process.

2. Do I need an Indonesian partner to open a company in Bali or Indonesia?

For most business activities, you do not need an Indonesian partner. PT PMA allows 100% foreign shareholding. However, in some sectors, such architecture may require an Indonesian partner. It is important to consult and determine your activity before creating your business in Indonesia.

Some sectors such as boat ownership still require 51% Indonesian partner while architecture, or design, travel agencies require 33% Indonesian ownership

3. How many shareholders do you need to open a company?

PT PMA is a form of LLC (limited liability company) that requires a minimum of two shareholders. Shareholders can be an individual and/or a corporation. If you have a company outside Indonesia and want to open a branch, the company can be the main shareholder. The second shareholder can be another entity you own or you as an individual.

The current minimum percentage of a shareholder is at 0.01% due to the minimum investment a foreign has to invest in a company (100 000 000 IDR).

4. How long does it take to open a company in Indonesia or Bali?

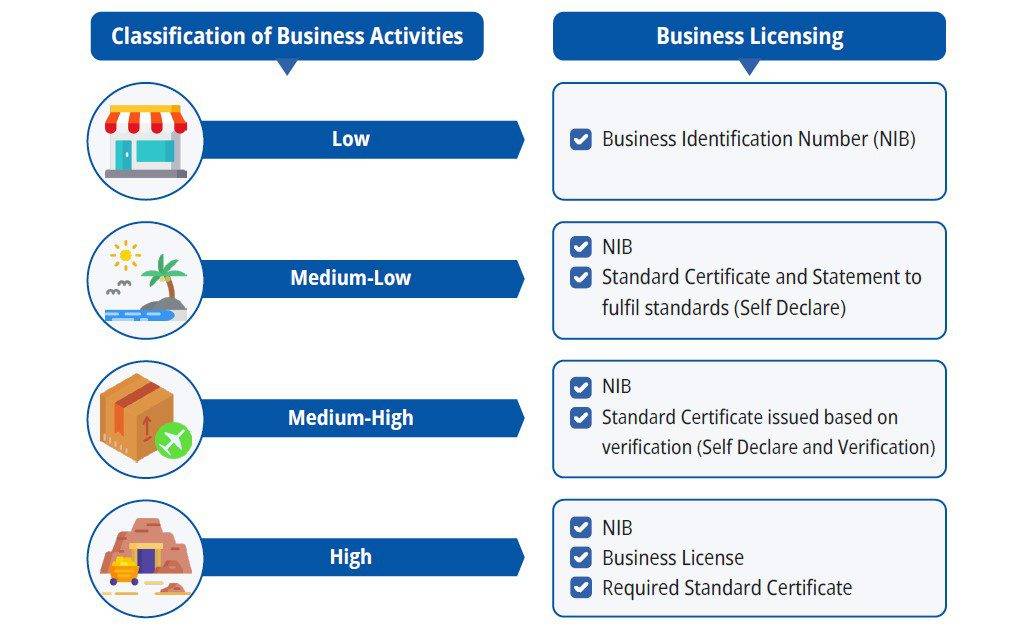

Opening a PT PMA in Indonesia takes 3 days to 2 weeks. Indonesia issues the business license based on the risk of the activity (from Low Risk to High Risk).

Depending on the level of Risk, some additional licenses might be required, and the verification process can take more or less time.

Once the company is open and have your tax card, you may need some additional approval (example: alcohol licence, import licence, education, etc.)

5. Can you open a representative office in Indonesia and Bali?

A foreign entity can open a representative office in Indonesia. The representative office (RO) cannot generate income in Indonesia. The RO cannot issue invoices. However, the representative office can hire foreigners and local staff. There are several types of representative offices, such as KPPA, KP3A, and BUJKA. The form of the representative office depends on the activity of the parent company and the activity in Indonesia. In some circumstances, it might be better to open a representative office than a PT PMA.

Opening a representative office is fast but requires to certify a few documents at the embassy.

6. What is the procedure to open a company in Indonesia and Bali?

To establish a PT PMA in Indonesia, you must follow specific procedures to create a business company in the country, including obtaining the necessary permits and fulfilling regulatory requirements:

- Sign a deed of establishment with a notary. You can use a company to assist you, and you do not need to come to Indonesia.

- Get ministry approval from the notary or the person assisting you

- Get the tax card of the company (NPWP)

- Obtain the business licenses (NIB and PKKPR) and certificate standards.

These steps are crucial to legally creating a company in Indonesia and Bali, ensuring compliance with local regulations and facilitating smooth business operations.

7. Can I open a company remotely?

It is not necessary to be in Indonesia to open a company. However, we recommend determining the correct structure based on your activity and tax exposure. The process can start online as long as the foreigner can provide a Power of Attorney. However the opening of the bank account has to be done with the director of the company coming to Indonesia to finalize the process.

8. Do you need a resident director?

It is not necessary to live in Indonesia to open a company. However, the company requires a resident director. A foreigner can be considered as a resident director if the director has a limited stay permit (KITAS). The KITAS can be obtained during the process by applying for an investor visa or a working permit. The director of the company will get a personal tax number to be able to declare the tax of the PT PMA or the RO.

9. What is the tax rate for a company in Indonesia?

Indonesia has a low tax rate for new companies. Companies are taxed at 0.5% on their revenue for the first 3 years if they do not exceed a certain amount of income. However, there are other taxes to consider in your tax planning. You can consult the article here. As an entity or foreign investor, we do recommend having proper tax planning for your company and planning in advance how your company will be taxed.

10. Can a company own asset in Indonesia?

Owning a manufacturer or a property in Indonesia is possible under a company. Your company will own the asset, and it will be integrated into your balance sheet. Certain assets in the mining industry will be concessions or long-term lease investments. Foreigners can own a villa, a manufacturer, a boat, a restaurant, or any other asset under a company. The set up of a company allows you to own assets that you would be able to only lease as an individual.

11. Can you buy an existing company in Indonesia?

Yes, you can buy a company in Indonesia rather than create a company in Indonesia from the beginning. You can change the ownership of the shares. The process takes more time than creating a new one. There will be a publication in the newspaper if the shareholder gives a certain amount of its shares.

12. What is the capital requirement to open a company in Indonesia?

The minimum capital required to create a company in Indonesia differs depending on the type of company. A PT PMDN requires 1 billion IDR if you have a foreign director or employee, while a PT PMA requires 10 billion IDR. A representative office such as KPPA doesn’t require a capital investment. The BKPM has authorized some companies to have a lower paid up capital in special economic zone.