Table of Contents

ToggleIn the past few months, I have engaged in lengthy discussions with clients, investors, and professionals, all inquiring about whether the Bali property market is on the verge of an explosive bubble. Assessing this appreciation is challenging, as every market is difficult to evaluate and each stakeholder has their own perspective.

- Investors are seeking reassurance about their investments.

- Real estate agents, promising a 25% return on investment (ROI) to sell properties with a limited lifespan.

- Agents dealing with visas for new resident

- Notaries having interest in a successful transaction.

- Developers with large investment engaged

Naturally, most actors adapt professional advice to their clients and offer services in the best interest of their clients.

As an investor with a financial background, I consistently view a property market as defined by demand and supply, with various variables, much like any other market.

Read also : How to Buy a Property in Bali?

The Offer in the Bali Property Market:

From Uluwatu to Canggu, Ubud, or East Bali, there has been a notable increase in property offers in recent years. Many Balinese have sought to sell or lease their land to generate cash during and after the COVID-19 pandemic. Interestingly, the most significant demand during this period came from Javanese buyers, capitalizing on the crisis to acquire land, while Balinese landowners were eager to liquidate their assets for cash.

This trend flooded the market with leasehold or freehold properties, such as villas, land, and hotels. Other nationalities joined the trend, buying and developing properties to offer off-plan villas or land.

As we approach the end of 2023, it’s time to evaluate the situation. The number of listings on short-term rentals in Bali has surged, reaching almost 58,500 listings on various platforms, marking a 22% increase.

This trend has continued until the end of this year in 2023 and it is now time to assess the situation.

If we take the number of listings for short-term rentals in Bali, no words can describe more than a graphic.

Make navigating real estate in Indonesia easy

Save time and money by letting ILA’s team of experts guide your real estate journey in Indonesia. We can help with due diligence, land title transfers, notary services, contract drafting and reviewing, building permits, various licences and more.

Find more information about our broad range of real estate services, or reach out today for a free consultation.

Is the demand keeping pace?

Investors typically seek returns through short-term rentals, long-term rentals, or capital gains. Due to investors’ confidence in property occupancy, capital gains depend on rising land demand. A bubble occurs when the market experiences capital gains based solely on hope. It can burst if buyers perceive a lack of real demand or if there are no tax advantages for buyers.

Current Demand Trends:

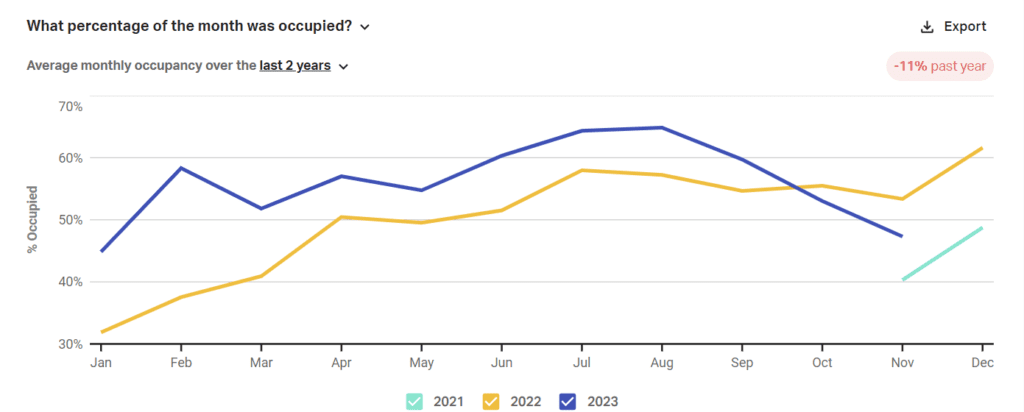

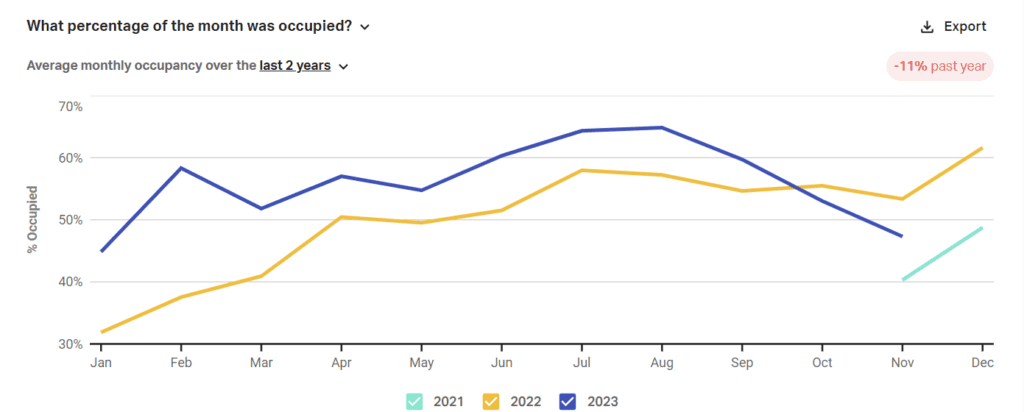

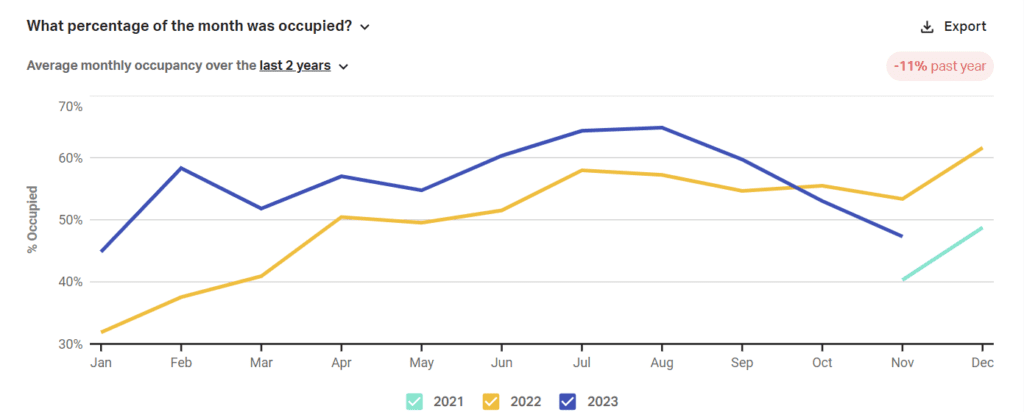

Airbnb numbers tell a revealing story. The occupancy rate for 2023 is falling below that of 2022, with several factors contributing to this decline:

- People are less inclined to travel far from their home country.

- Savings need replenishing.

- Bali’s reputation as a crowded destination with high traffic is affecting its appeal, especially as other places offer better infrastructure

Read also: Bali Property Market Trend 2023 – 2024

Property Occupancy Rates in Bali

Property Occupancy Rate in Ubud

Property Occupancy Rate in Canggu Area

Canggu, in particular, shows a significant drop from over 65% to around 50% in occupancy rate.

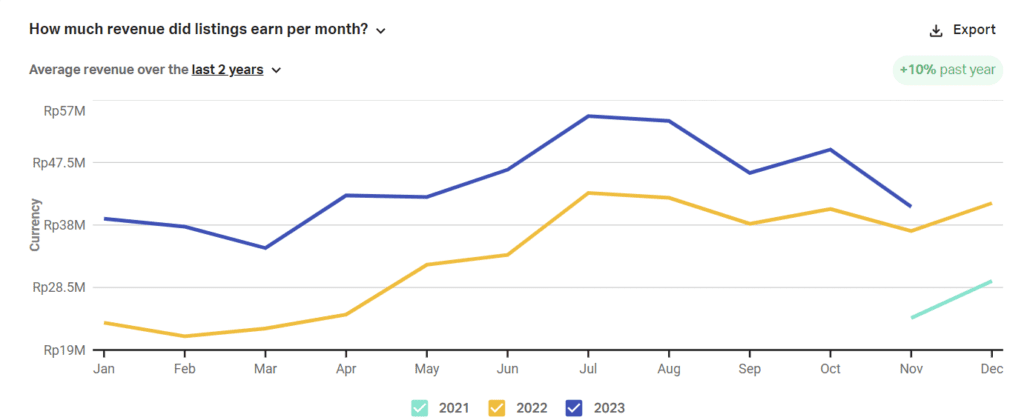

Despite a declining market trend, revenue took time to follow suit due to higher listing prices. Property owners with short leaseholds aimed for fast ROI by listing at premium prices when demand was high. However, a general trend of declining revenue is emerging, aligning with the total revenue of 2022.

This trend indicates that revenue persists but is distributed among more listings with lower occupancy rates. In this competitive landscape, having a strong partner is crucial for differentiation.

REVENUE OF BALI PROPERTY MARKET ON SHORT TERM RENTAL

To Invest or Not in the Bali Property Market?

The answer is both yes and no. We recommend clients formulate a robust business plan and thoroughly understand the location of their investment. Acquiring Freehold property (HGB or Hak Pakai) is crucial, especially in a downturn, as leasehold becomes a double penalty, losing value due to the market and having a shorter lease duration.

Key considerations include:

- Always do a market study and study numbers (not the ones from the seller)

- Always understand your customers behaviour and their travel trends. A lot of promoters try to bring apartments on the market. Is Bali the place people want to stay in an apartment? Are clients going to fly out from New York to stay in an apartment?

- Understand the changes. India is becoming one of the biggest markets for Bali. Are Indians staying for 4 days or 2 weeks? Will they spend as much as in other markets? Will it be perfect to stay in a 5-star hotel, an apartment, or a villa?

- Make sure your contract is secured and you perform the correct due diligence.

- Is long-term rental another alternative? Can I look at the Indonesian market?

- Have a proper marketing strategy and property management company

Bali will always be Bali. Indonesia is a strong market with an important local market. But Indonesia is more than Bali and offers a lot of new opportunities to develop sustainable forms of tourism.

Sumba, Raja Ampat, and those islands on the east coast of Indonesia show that their occupancy rates can stay very high. Some resorts, such as Misool Eco Resort, are fully booked years in advance. Some resorts in Sumba also still have a strong occupancy rate that is increasing.

How can you help me decide whether to invest or not in Bali or Indonesia?

We can assist you in studying the market, providing insights, data, and recommendations. As investment and legal advisors, we offer comprehensive legal advice and assistance throughout your investment process to ensure your interests are protected.

Investors should adopt a medium- to long-term perspective. Indonesia offers various submarkets that demand careful consideration. The Bali trend has pushed a lot of investors to develop properties that are not currently finished or developed, but the enduring appeal of Bali to visitors suggests a potential return when these developments are completed. Bali has been an attractive destination for years and will continue to draw investors.