Table of Contents

ToggleBali is a gem for Digital Nomad who wish to get a residency in a country outside their home country. Since the E33G Remote Worker Visa, Digital Nomad can now work legally and remotely from Bali and receive incomes in an Indonesian Bank account.

There are several countries offering solutions to Digital Nomad and Indonesia is certainly a place offering one of the best arrangements in terms of Visa and Taxation.

Overview :

Digital nomads residing in Bali may be considered Indonesian tax residents if they:

-

Stay in Indonesia over 183 days,

-

Hold a KITAS/KITAP, or

-

Intend to reside or have economic interests in Indonesia.

Indonesia offers a remote worker visa (E33G), allowing a 1-year stay with multiple entries, and eligible digital nomads may apply for tax exemptions on foreign-sourced income for up to 4 years under certain conditions (PMK No. 18/PMK.03/2021), especially if they have specialized expertise.

Alternatively, digital nomads can set up a PT PMA (foreign-owned company) to obtain an investor or working KITAS, allowing longer stays (up to 2 years) and corporate tax benefits like lower rates and tax-free reinvested dividends.

Residency in Bali as a Digital Nomad

A foreigner is considered a tax resident in Indonesia if the taxpayer::

- Resides in Indonesia for more than 183 days

- Consider having a resident in Indonesia (having a KITAS or KITAP)

- Intends to reside in Indonesia or has an economical permanent interest

Remote worker visa

In the battle between countries to attract digital nomads, Bali province has definitely won its place as leader. The last remote worker visa now allows digital nomads to get a limited stay permit (KITAS) for 1 year, and remote workers want to use this opportunity to optimise their personal tax or income taxation.

In addition to allowing a one-year stay in Indonesia with this multiple-entry visa (E33G), remote workers and digital nomads receive some tax benefits detailed below.

Setting up a PT PMA (LLC)

Another option for digital nomads is to also set up their own company in Indonesia in order to invoice their clients and get tax residency. By setting up their own PT PMA (LLC), digital nomads or remote workers can apply for an investor KITAS or Working KITAS. This allows them to stay in Indonesia for up to 2 years. The company will tax their revenue and offer tax benefits during the first years of business. These benefits include lower corporate income tax and no tax on reinvested dividends.

Also read: Understanding VAT and Income Tax For Crypto Assets in Indonesia

Never worry about taxes and accounting again

Dealing with finances, taxes, and accounting can feel overwhelming, especially as a foreigner in Indonesia. Let us guide you through processes like tax calculation, payroll, personal or corporate tax, short-term investments, balance sheet analysis and much more.

With ILA by your side, nothing can go wrong. Schedule a free consultation today or learn more about our tax and accounting services.

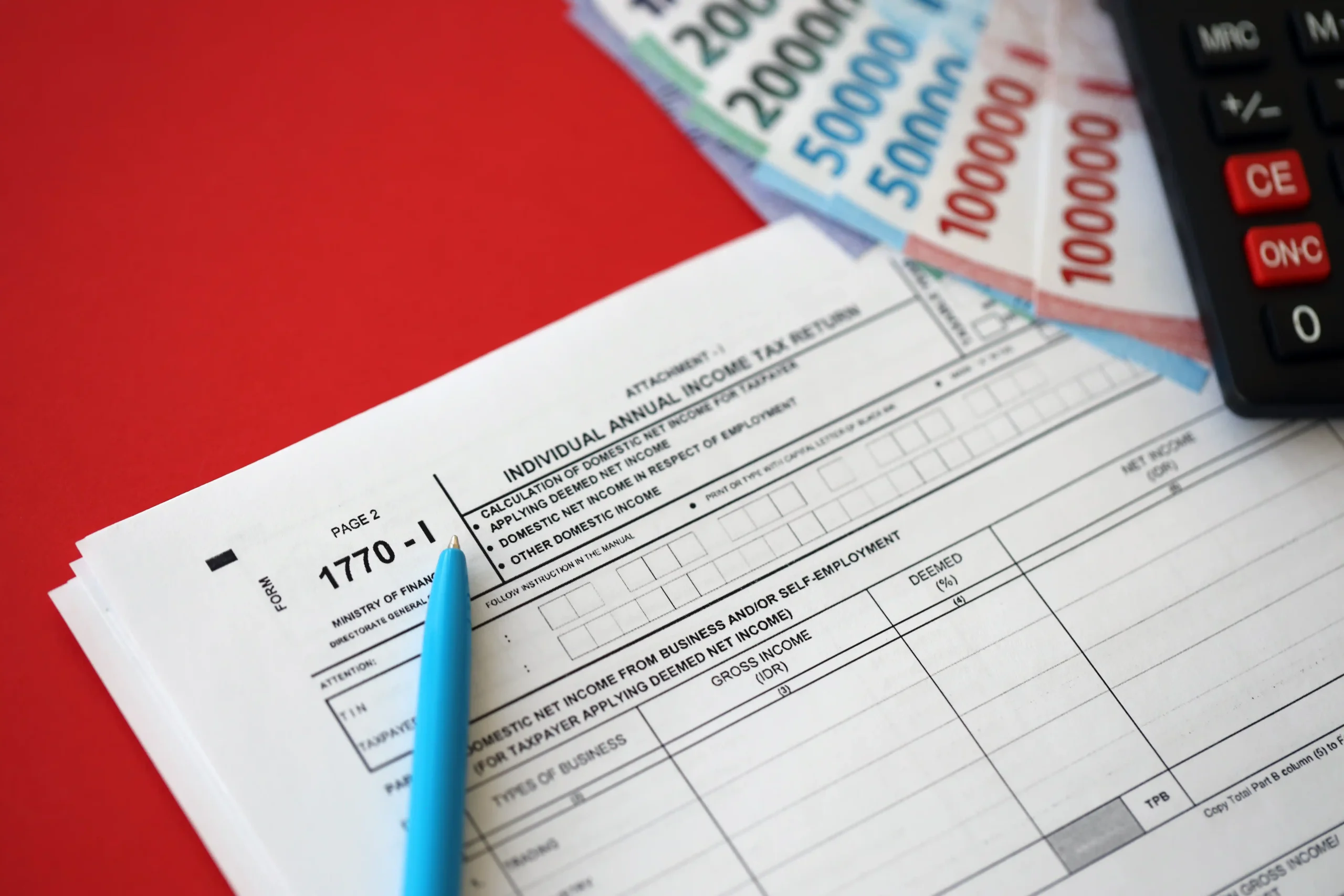

Tax for Digital Nomad or Remote Workers in Bali

Principle of worldwide income and territoriality

Indonesia applies the principle of Worldwide income. This means that, in theory, all taxpayers have to declare their worldwide income, and the tax office uses this base to apply the taxation. However, the regulation provides some exemptions for some foreigners during the first 4 years of residency in Indonesia. Indeed, the regulator applies the principle of territoriality if the foreign national meets the provisions for having certain expertise (attachment II of PMK No. 18/ PMK.03/2021) and has been in Indonesia for less than 4 years (Nomor 18/PMKc03/2021).

In other words, digital nomads can apply for a remote worker tax exemption on their income from outside Indonesia. If they are not taxed in another country, they might pay no tax at all. For example, revenue from an LLC in a country that does not tax corporate income or dividends.

However, the digital nomad needs to apply for the tax exemption, and it is not automatically applied.

Obligations for the Digital Nomad

Despite the tax exemption, the digital nomad or remote worker with a KITAS (or considered a taxpayer, as mentioned) must fulfil their responsibilities and obligations.

- Apply for a tax number (NPWP)

- Report its personal income tax between January and March following the fiscal year.

- Declare its residency (apply for an SKTT)

- Report its personal assets and liabilities even if they are not taxed

We advise the digital nomad and remote worker to take this matter into consideration and account to avoid any issues with renewing their KITAS or any tax penalties in the future.

Contact ILA to know more on how to optimise your tax profile and understand how the taxation in Indonesia applies to digital nomad and remote workers in Bali (with a E33G or not).