Table of Contents

ToggleDuring the process of purchasing a property in Bali, one recurring question we got was how to buy a property in Bali and the rest of Indonesia. The main purpose is obviously to understand the legality of the law and to understand the best way to be tax efficient and protect the investment.

While some agents push the process to go fast, considering the best way to optimise the investment is crucial to facilitate the transmission of the investment. As a reminder, nominees are totally illegal in Indonesia and are not secure for investment. We will not study below this option and focus on buying a property as an individual or under a company.

Buying a property under a personal name or company

Buying a property as an individual

Indonesian law authorised individuals to purchase leaseholds. A leasehold contract is a long-term agreement transferring some rights to a party during a certain period. For example, you can rent for a period of 10, 20 or 30+ years a villa in Bali. You will get the rights to a property based on the terms and conditions.

The other option is to buy an apartment or a villa under Hak Pakai. The Hak Pakai “Right to Use” gives the right to the buyer on the property for a duration of up to 80 years. The advantage compared to the leasehold is that the buyer becomes the owner of the property and can eventually resell the property at the price of a freehold. Each province, such as Bali, Jakarta, Lombok, etc., defines the minimum requirements for getting a freehold under Hak Pakai. If you’re looking to buy a property in Bali, considering options like Hak Pakai could be beneficial.

Buyers can also obtain a stay permit (KITAS), such as a Second Home Visa, by buying a property in Indonesia. The minimum requirements have changed in the last few months, so we invite you to contact us to learn more about the options for property acquisition and property ownership.

Buying a property under a company

In recent years, the Indonesian government has authorised foreigners to establish corporations to purchase properties under a leasehold or a freehold (Hak Pakai, HGB, for example). In other words, buyers can buy a property or lease a property in Bali under a PT PMA.

Differently from the individual, a company can purchase freehold lands while individuals are limited to leasehold. Freehold offers obvious advantages, such as the possibility of transferring ownership to the next generation through some mechanism. Real estate investment is a key consideration in such purchases. One of the important factor is the ability to apply for a “Vila license” under the PMA to be able to manage and rent the property legally.

LEASEHOLD vs FREEHOLD

| LEASEHOLD | FREEHOLD | |

| Individual | Hak Sewa | Hak Pakai (only villas and apartments with a minimum value) |

| PT PMA | Hak Sewa | Hak Pakai

HGB |

| Duration | No limit | 30+20+30

Extension |

| Ownership | No | Yes |

| Business as individual | No | No |

| Business as company | Terms and conditions in the contract | Yes |

| Selling option | According to contract | Yes |

Make navigating real estate in Indonesia easy

Save time and money by letting ILA’s team of experts guide your real estate journey in Indonesia. We can help with due diligence, land title transfers, notary services, contract drafting and reviewing, building permits, various licences and more.

Find more information about our broad range of real estate services, or reach out today for a free consultation.

How to optimise your tax to buy a property

This section will cover the legal ways to optimise taxes in Bali and Indonesia when you buy a property, including tax-saving strategies.

There are some common practices for establishing two lease agreements established by the notary that will not be covered here as it has some consequences:

- It is illegal

- You cannot claim your money back in case of litigation and have no proof for the tax office in your home country if they ask you why you had to pay overseas.

- You will not be able to claim the full amount of your investment in your company.

Tax on individual property rental

Renting out a property in Indonesia is illegal for Foreigners under their personal name as the operation to rent a property out requires a licence even for Indonesian citizens.

One possibility for a foreigner to rent a property out as an individual is to delegate the management of the property to a management company. This management company will need to proceed with the licence under the villa.

In this option, we assume the property has the correct legal documents, such as a building permit (PBG/SLF), in order to obtain the licence (Vila or Pondok Wisata, for example).

Once the property gets the licence, the property management will distribute the revenue after paying the local tax and paying its management fee.

Tax on Non-resident

The taxation will then be 20% of the remaining income. This tax is a withholding tax on money sent to non-residents. Some tax treaties offer lower taxation rates, but they need to be studied case by case.

Tax on Resident (KITAS Holder)

KITAS holders are responsible each year for declaring their personal income tax. An income coming from a company without any capitalistic relation will highly affect the personal income tax of the resident. Indeed, the progressive rate is important, with a last threshold of 35%.

Read also: Bali Development Blueprint: Indonesia Real Estate Developer Guide

Tax on companies on property rental

A company offers more tax advantages than at the individual level, and it also offers more flexibility to rent out a property legally.

In short, a company can be classified as a property management company or real estate company (contact us how to rent out a property legally or consult our other article here)

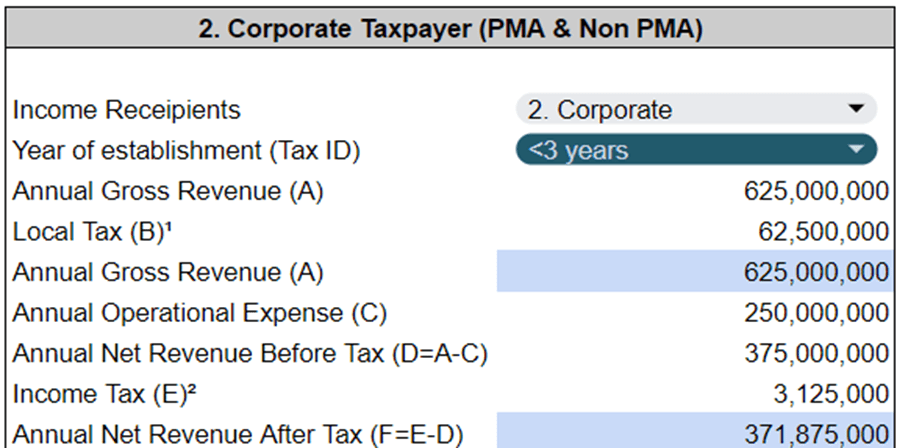

Once the property management company has paid the local tax, then the company will be taxed at 0.5% on its income during the first 3 years if it doesn’t exceed a certain level of income. As a shareholder and under certain conditions, the shareholder of the company can apply for a KITAS and get the status of residence with a taxation of 10%. In other words, having a company can reduce the tax by almost 50%, as shown in the simulation below. More than that, if shareholders decide to reinvest the dividend in the company or another company, they can benefit from a tax exemption on their dividend and be taxed at 0%.

Taxation under a company or individual

| Individual | Shareholder | |

| Local tax | 10% | 10% |

| Income tax | – | 0.5% |

| Withholding tax | 20% | 10% |

| Total tax out of local tax | 20% | 10.5% |

| Total tax if the dividend is reinvested | 20% | 0.5% |

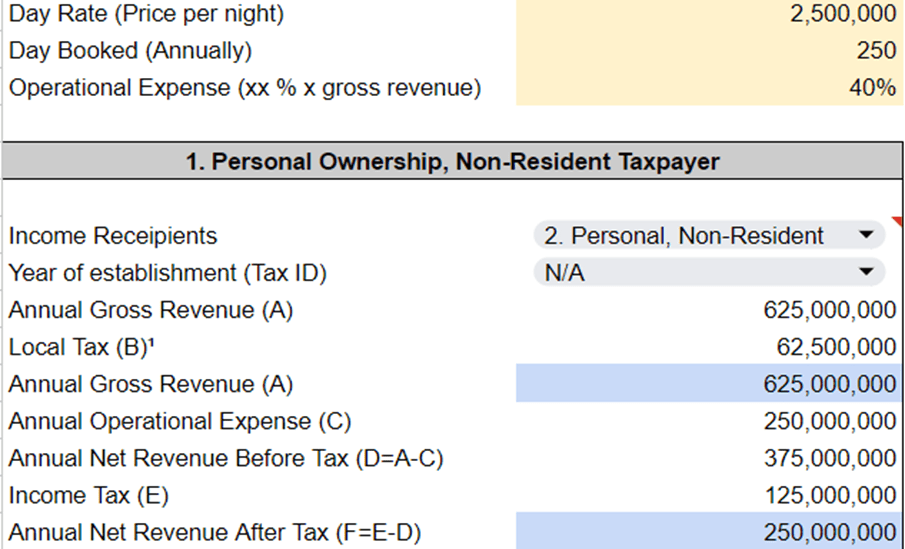

Income simulation as an individual and as a company

Net income with a company and as an individual

For the same property, the revenue net after taxation can be significant. Indeed, on this simulation, we can see that for revenue of 625 000 000 IDR, the net profit can be 121 875 000 IDR higher through a property.

Having a property under a company makes your business legal, you obtain a stay permit and your profit is higher. Are you still hesitating to set up a company to start your business rental on Airbnb?

Contact us to learn more about the legality of the property and get a simulation of the revenue for your property in Bali and Indonesia.

FAQ

1. What are the legal options for purchasing property in Bali and Indonesia?

Individuals can purchase leaseholds or obtain the \”Right to Use\” (Hak Pakai) for a duration of up to 80 years.

2. What is the difference between leasehold and freehold property ownership?

Companies can purchase freehold lands, providing advantages such as the ability to transfer ownership to future generations.

3. How can individuals optimize taxes when buying property?

Taxation for non-residents is typically 20% of the remaining income, while KITAS holders are subject to personal income tax rates.

4. What tax advantages do companies offer for property rental?

Companies are taxed at 0.5% on income for the first three years if income remains below a certain level.