Table of Contents

ToggleThe Bali property market trends is undergoing notable shifts as we move through 2023 and into 2024. With occupancy rates stabilizing around 59% and slight increases in property values, the market reflects both opportunities and challenges. Factors such as rising entries into Bali and evolving investor strategies are shaping the landscape. However, questions remain about whether current and upcoming developments will meet future demand. Understanding market dynamics, regulatory changes, and regional alternatives like Lombok and Phuket is essential for navigating investment decisions effectively.

How will the Bali property market trends go in 2024?

The year has started, and we still hear a few different approaches to looking at the property market. Some real estate agents try to push other destinations, but we have also promoted other areas such as Sumba. But how is this market going now?

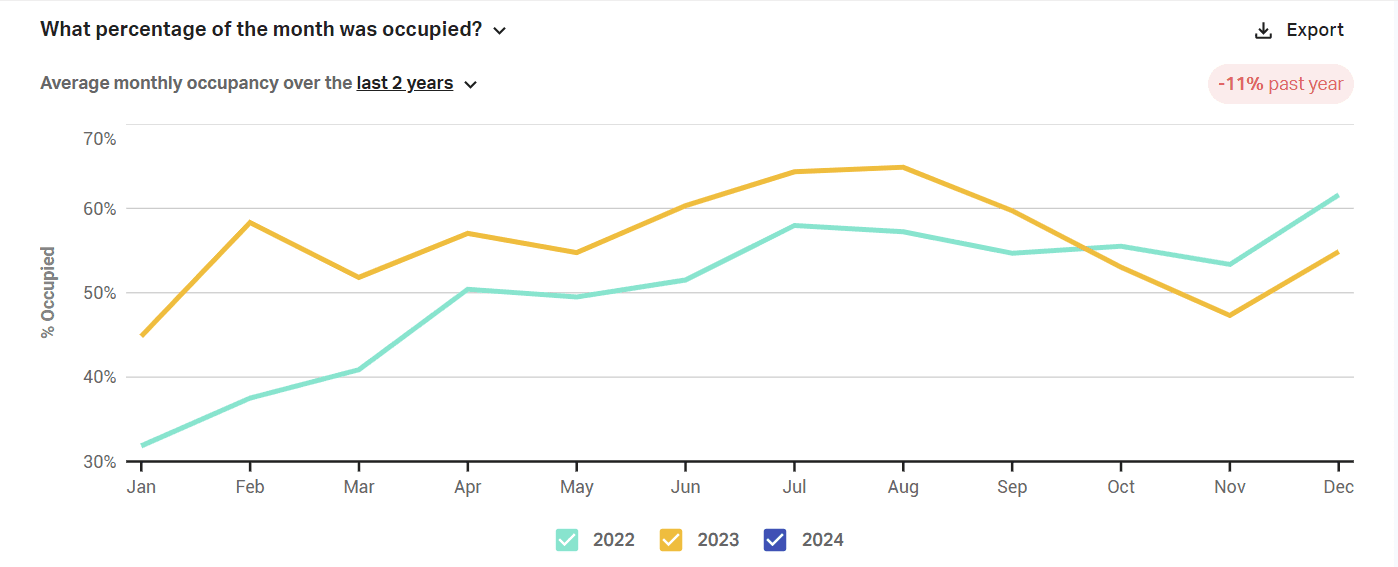

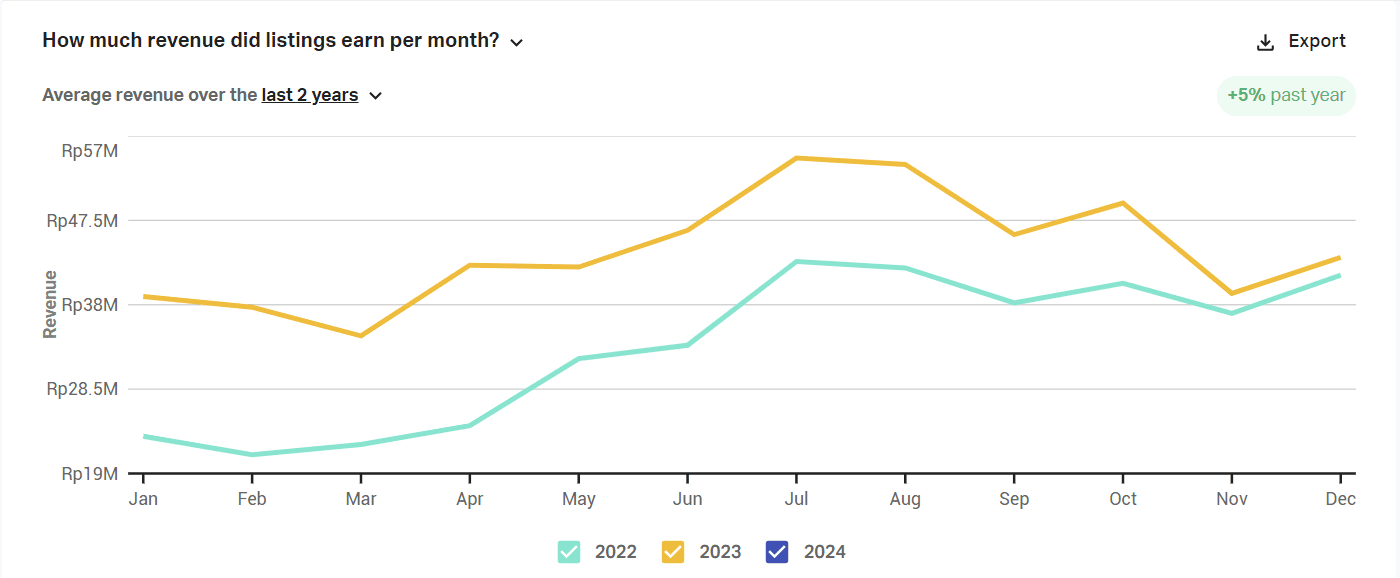

After reviewing the number for 2023, the occupancy rate for 2023 and the beginning of 2024 is still under the occupancy rate of 2022. The value in USD is slightly higher. Two main factors:

- The prices are slightly higher as the business owner has increased their price compared to 2022.

- The number of entries in Bali has increased.

However, the revenue at the beginning of 2024 seems to be the same as in 2022. It seems that the number of entries did not follow the property investment done in the last few months. The average of the occupancy rate is stabilising at 59%.

Bali seems to have reached a point in July or August 2023. The question is now to know if the person who has invested in 2023 and is currently building will be covered in 2024.

Make navigating real estate in Indonesia easy

Save time and money by letting ILA’s team of experts guide your real estate journey in Indonesia. We can help with due diligence, land title transfers, notary services, contract drafting and reviewing, building permits, various licences and more.

Find more information about our broad range of real estate services, or reach out today for a free consultation.

Lombok an alternative?

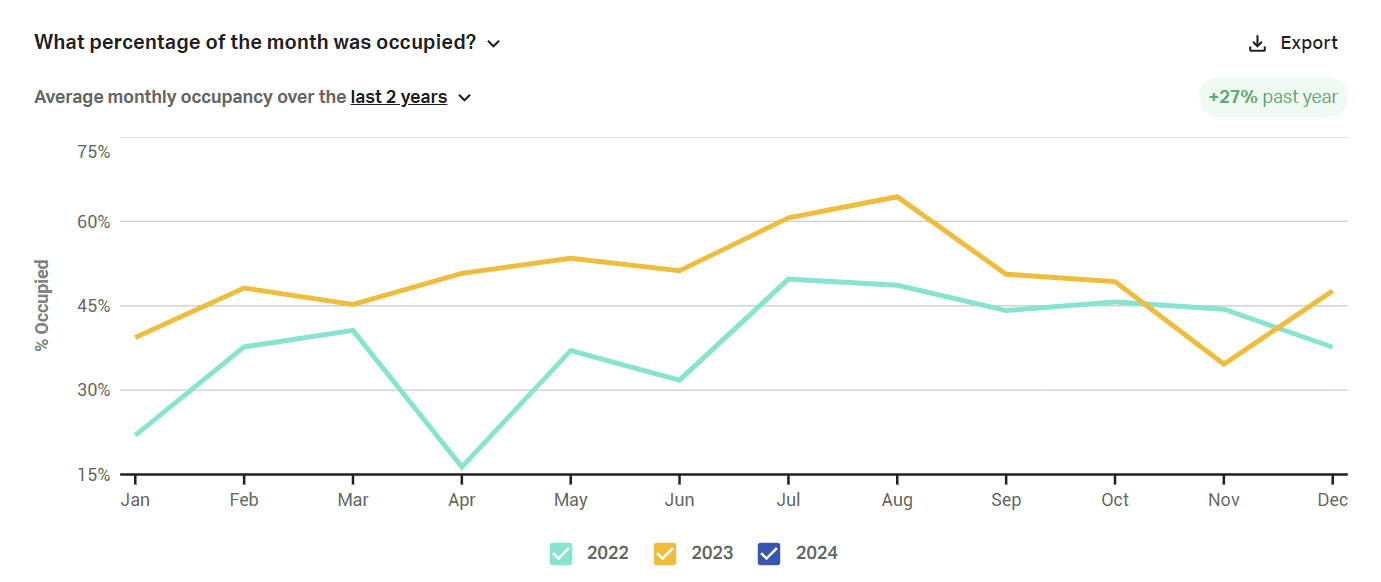

While some are trying to place Lombok on the master plan, we can notice that the occupancy rate was similar to Bali, but with a very low occupancy on average of around 30%. Lombok seems not for now to be the expected market that some promoters try to promise. However for investors with a premium location and a good strategy the place can be interesting to look at.

The election in a few months will determine the future of the next few years. While the country is taking a different direction, social factors have a strong influence on how and where people want to spend their money and vacation.

Is Thailand better?

By continuing our analysis we started to take a look at the numbers in Phuket, Thailand. Phuket seems to have a higher occupancy rate at its peak but is more affected by the variability of the seasons. Phuket has had a lot of construction in the last few months, and the occupancy rate seems also affected by the number of constructions increasing faster than the demand.

Where to invest?

Bali and Phuket or Lombok will see a lot of new construction finalized in the next few months following the purchase or lease of the last few months. The question is to now identify if the demand will follow or not.

In a long time, there is no doubt that this demand will continue. Spain had this issue in the past and Asia has a strong domestic market to come. However, the incertitude is never good for an investor. Politics have to continue to improve infrastructure and send good signals to travelers willing to invest and occupy those properties.

A few weeks back, I remember having a discussion about investing in Bali and France. An interesting fact is that Paris has a higher occupancy rate than Bali, despite what we could expect. With 75% compared to 59% in Bali, Paris seems a place where stability of the tourism industry is for example guaranteeing a certain level of revenue to the investor.

Indonesia has a strong potential. The location of the investment is key. We do trust that it is the right moment to invest, but knowing how to do it is the key

- Location

- The durability of the investment

- Property matching with the target market of Bali or the rest of Indonesia

- Competition analysis

- Tax analysis and planning

- Right financing

Also read: How to Buy a Property in Bali?